Settlement accounts provide a number of important features to complement Token.io's payment initiation services.

A Token.io settlement account is similar to a bank account that allows deposits and withdrawals, and has the following features:

an account identifier, which can be an IBAN (Netherlands, Ireland, Spain and France) or a sort code and an account number (UK only)

a balance

an external address, so that the account can receive payments from other banks even if the payment was not initiated by Token.io

support for outgoing payments initiated through Token.io, including payouts and refunds

support for Faster Payments (UK only), SEPA and SEPA instant (Europe)

By using settlement accounts you can take advantage of the following capabilities from Token.io, for single immediate payments, variable recurring payment initiations and future dated payments:

Real time notifications - when you initiate an account-to-account payment, you may need to know when the funds have reached the payee (beneficiary) so that you are able to take suitable actions. An example of this is an e-commerce payment where your customer needs to know if goods or services are to be released to the payer. Your customer in this case is a consumer of the service provided by you, and could be a TPP, or a merchant, or your merchant customer.

Refunds - you may need to support the initiation of refunds. In this case, the payee will need to return the funds to the payer. An example of this includes a situation where a payer has purchased a certain item and now wishes to return it to your customer. Your customer in this case is a consumer of the service provided by your, or your merchant customer.

When a payout is initiated, you should ensure that the remittance reference (refId) in the payout request includes the merchant name. This is to ensure that the beneficiary, in this case it could be an individual, is able to recognize the transaction on their bank statement.

The refId field is limited to 18 characters. To meet this requirement, use a shortened form of the merchant name along with a unique identifier to make the reference unique.

Payouts - in this scenario the beneficiary could be an individual. An example of this is where one of your customers is an online gaming provider. The online gaming provider will need to provide an option for the user to withdraw their earnings.

Settlement to beneficiary accounts - you may need to transfer funds to your customers’ accounts. This is referred to as settlement, where the final intended recipient of the funds receives the funds. In this case, your account is the payee or the payee’s customer’s account, e.g., the merchant customers of the TPP account.

For a merchant name to be included in the end user’s Bank statement, we recommended that the merchant name is added to the remittanceInformationPrimary and remittanceInformationSecondary fields when initiating a payment.

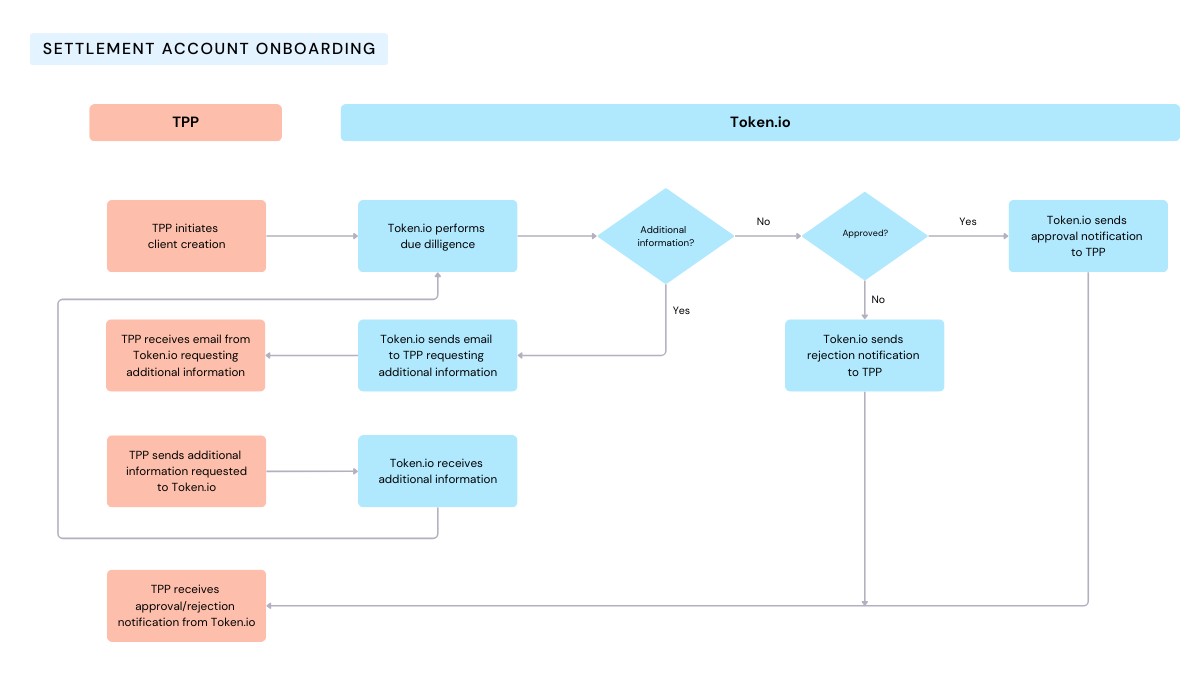

The flow diagram below shows how onboarding will work. Once you're approved, Token.io will notify you so that you can proceed with the next steps for creating the settlement account.

You have an option to create two clients if you have separate organizations for the UK and EU, and need them to be separate.

In a scenario where you aren't regulated but your sub-TPP requires a settlement account, you'll need to submit the sub-TPP’s details to Token.io for due diligence.

Account setup varies depending on whether you are regulated or not. A regulated TPP is a PSP that has either an Electronic Money Institution (EMI) license or a Payment Institution (PI) license.

The following table shows the how the setup options vary between regulated an unregulated TPPs with single and multiple settlement accounts.

| Regulated TPPs | Unregulated TPPs | |

|---|---|---|

| Single settlement account |

|

|

| Multiple settlement sub-accounts/accounts |

|

|

The following diagram shows how regulated multiple settlement accounts can be set up. The Settlement accounts are created as sub-accounts and belong to you. Your customers have no access to these accounts.

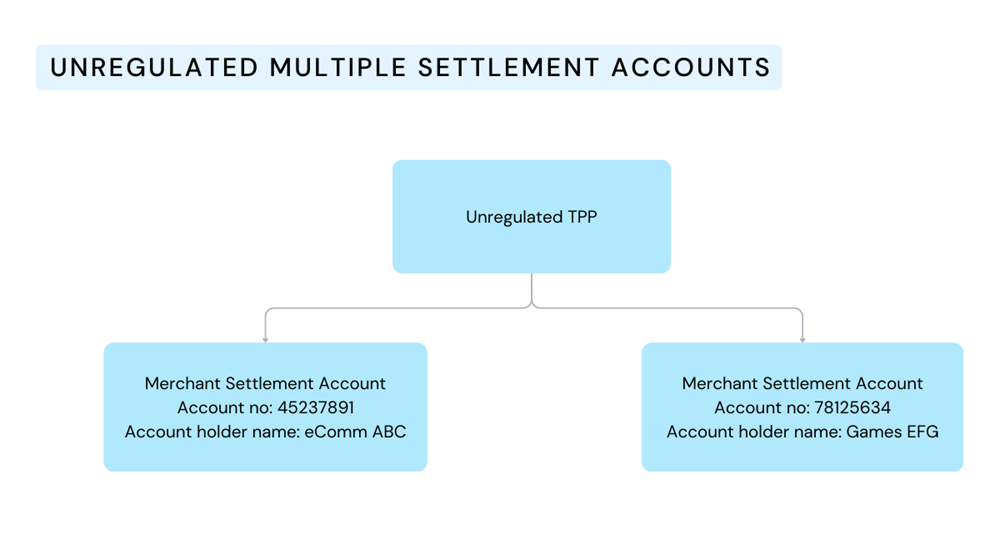

The following diagram shows how unregulated TPPs can set up individual, externally addressable, settlement accounts for your customers.

The features available for Token.io settlement accounts are similar for regulated and unregulated TPPs. However, for single settlement accounts for your customers (sub-TPPs), the account will be created at the sub-TPP level instead of at the TPP level.

You can set up a single account or choose to have multiple sub-accounts.

For multiple accounts, you'll need to use the onBehalfOfId to identify the sub-TPP or sub-TPP group that the accounts will be used for.

We also recommend that you use the accountNickname to make it easier for sub-TPPs to identify the settlement account.

The account is used as the beneficiary (payee) account for you in all account-to-account payment initiations. The following capabilities are supported:

| Capability | Description | Key Input parameters | |

|---|---|---|---|

| Create account | |||

| Allows a TPP to create an account. Only one account can be created with one API request. | |||

| Currency | Member Id (generated when the TPP onboards) | Account nickname |

| Retrieve account details | |||

| Allows a TPP to retrieve the current account details for one or more accounts. | One or more account identifiers. | ||

| Retrieve account transactions | |||

| Allows a TPP to retrieve transactions corresponding to an account. | One or more account identifiers. |

To test the Settlement Accounts endpoints, use our Launchpad.

The accounts are externally-addressable, enabling the TPP to receive payments from other banks even if the payment was not initiated by Token.io. The only way the TPP can instruct outgoing payments is via Token.io (except Direct Debit, which won't be enabled by default and is only available in the UK currently). These accounts can also be used to initiate payouts and refunds.

Token.io recommends that you maintain sufficient balance in the account to handle refunds and payouts. The minimum balance maintained should ideally be about 10-15% of the total daily volume of Open Banking payments expected by you.

Token.io will set up velocity controls for the purpose of transaction monitoring. However, these will be discussed during onboarding and should not affect normal account activity. Accounts cannot go negative, so a transaction request will fail if sufficient balance is not present. UK Faster Payments has a transaction limit of £1M GBP, if the amount is greater, Token.io will send the payment by CHAPS which may not be real-time, as there is a cut-off time for same day payments (4pm). SEPA Instant has a transaction limit of 100,000 EUR and payments over this amount will be sent as standard SEPA credit transfer. The recipient bank must be able to accept SEPA instant also, otherwise it will also fall back to SEPA Credit Transfer.

Settlement accounts can be referenced in the payment initiation request. This can be a Single Immediate Payment v2 or v1 request. The beneficiary account details must contain the settlement account information.

Token.io performs the match on a continuous basis (the period of polling will depend on the Payment rail) until a match is found. The polling will take place every 90 seconds for the first 15 minutes, followed by every 5 minutes for the next 15 minutes. After this, the polling will take place every hour for the next 24 hours. After 24 hours, polling will take place once a day for the next 30 days for SEPA Instant and Faster Payments, and 44 days for SEPA payments.

Token.io notifies you as soon as a match is found. Token.io sends a webhook to the TPP whenever the payment initiation status changes. This ensures that you can immediately notify your customer, so that the customer can proceed with the next steps.

For further information on payment initiation, see Single Immediate Payments (PIS) v2 or Single Immediate Payments (PIS) v1.

If you have any feedback about the developer documentation, please contact devdocs@token.io