The Settlement Rules feature enables Third-Party Providers (TPPs) to automate the initiation of transfers from their settlement accounts at defined intervals. A settlement rule can be:

- A fixed amount

- A percentage of the remaining balance

Rules can occur intraday , daily, weekly, monthly, quarterly, every six months, or annually.

Settlement rules can be set up via the Dashboard or via API.

Single Rule per Account: Only one settlement rule can be set up per virtual account. Attempts to create additional rules for the same account are rejected.

Rule Modification: Settlement rules can be updated. Changes take effect from the next scheduled execution.

Rule Deletion: Settlement rules can be deleted at any time. Payments already initiated will continue processing and are not cancelled.

Validation: All API requests are validated for required fields and business rules.

Error Handling: The API provides meaningful error responses for invalid input or business rule violations.

POST /virtual-accounts/{account_id}/settlement-rule

The settlement rule creation request includes the following parameter:

- Payer account

- Payee details

- Amount type (fixed or percentage)

- Value

- Effective dates

- Interval

Upon the settlement rule being created successfully, a settlement rule ID will be provided in the API response.

Example Request:

{

"accountId": "pa:8DbPteGnytmMbKXdnWTReeRB6cYWKXZ84JgLTBC7fKL4:5zKcENpV",

"payeeAccountDetails": {

"name": "Customer Inc.",

"ultimateCreditorName": "Customer Inc.",

"bankName": "string",

"accountNumber": "12345678",

"bic": "HBUKGB7F261",

"iban": "GB29NWBK60161331926819",

"sortCode": 123456

},

"amountType": "FIXED_VALUE",

"amountValue": 10,

"timeInterval": "INTRADAY",

"effectiveFrom": "2024-01-01T12:34:56Z",

"effectiveTo": "2024-12-01T12:34:56Z",

"intradayIntervalHours": 2,

"intradayIntervalMinutes": 10,

"description": "Auto Payout"

}Example Response:

{

"settlementRuleId": "123e4567-e89b-12d3-a456-426614174000"

}GET /virtual-accounts/{account_id}/settlement-rule

Returns the current settlement rule for the specified account. The response will also highlight if the rule is "ACTIVE" or "INACTIVE".

Example Response:

{

"settlementRule": [

{

"settlementRuleId": "c65e5548-682b-4c4e-b000-f496e06d1082",

"payerAccountId": "string",

"payeeAccountDetails": {

"name": "Customer Inc.",

"ultimateCreditorName": "Customer Inc.",

"bankName": "string",

"accountNumber": "12345678",

"bic": "HBUKGB7F261",

"iban": "GB29NWBK60161331926819",

"sortCode": 123456

},

"amountType": "FIXED_VALUE",

"amountValue": "string",

"effectiveFrom": "string",

"effectiveTo": "string",

"timeInterval": "INTRADAY",

"description": "Auto Payout",

"status": "ACTIVE"

}

]

}DELETE /virtual-accounts/{account_id}/settlement-rules/{settlement_rule_id}

Removes the specified settlement rule. If successful, a HTTP 200 response code will be received with an empty body.

GET /virtual-accounts/{account_id}/settlement-rules/{settlement_rule_id}/payouts

Retrieves a list of payments initiated under a specific settlement rule.

Example Request:

{

"accountId": "pa:8DbPteGnytmMbKXdnWTReeRB6cYWKXZ84JgLTBC7fKL4:5zKcENpV",

"limit": 10,

"offset": "LerV6Jmex",

"settlementRuleId": "123e4567-e89b-12d3-a456-426614174000",

"startDate": "2024-01-01",

"endDate": "2024-12-01",

"ids": [

"123e4567-e89b-12d3-a456-426614174000"

],

"invertIds": false,

"statuses": [

"INITIATION_PENDING",

"INITIATION_PROCESSING"

],

"invertStatuses": false,

"refIds": [

"ShBdcTeqFabqJJhUF"

]

}Example Response:

{

"pageInfo": {

"limit": 20,

"offset": "LerV6Jmex",

"nextOffset": "KgwG8Qkat",

"haveMore": false

},

"payouts": [

{

"id": "py:12345abcd:abcd",

"bankTransactionId": "2UhwCZ3BMaEcAUK8bZdukor7NL4tH6TBuu6aJMp5KKfX:5zKcENpV",

"memberId": "m:123456abcd:abcd",

"createdDateTime": "2024-04-05T00:00:00.000+00:00",

"updatedDateTime": "2024-04-05T00:00:00.000+00:00",

"status": "INITIATION_COMPLETED",

"bankPaymentStatus": "ACPC",

"statusReasonInformation": "The payment is settled on debtor side.",

"initiation": {

"description": "e49j-2145-sp17-k3h0",

"refId": "9htio4a1sp2akdr1aa",

"onBehalfOfId": "c5a863bc-86f2-4418-a26f-25b24c7983c7",

"amount": {

"value": "10.23",

"currency": "EUR"

},

"debtor": {

"accountId": "a12345"

},

"creditor": {

"name": "Customer Inc.",

"ultimateCreditorName": "Customer Inc.",

"bankName": "string",

"iban": "GB29NWBK60161331926819",

"bic": "BOFIIE2D",

"accountNumber": "12345678",

"sortCode": 123456,

"accountVerificationId": "string"

}

},

"reference": "ShBdcTeqFabqJJhUF",

"description": "Description of the payout",

"settlementRuleId": "123e4567-e89b-12d3-a456-426614174000"

}

]

}The following outlines the process of setting up a Settlement Rule within the Dashboard.

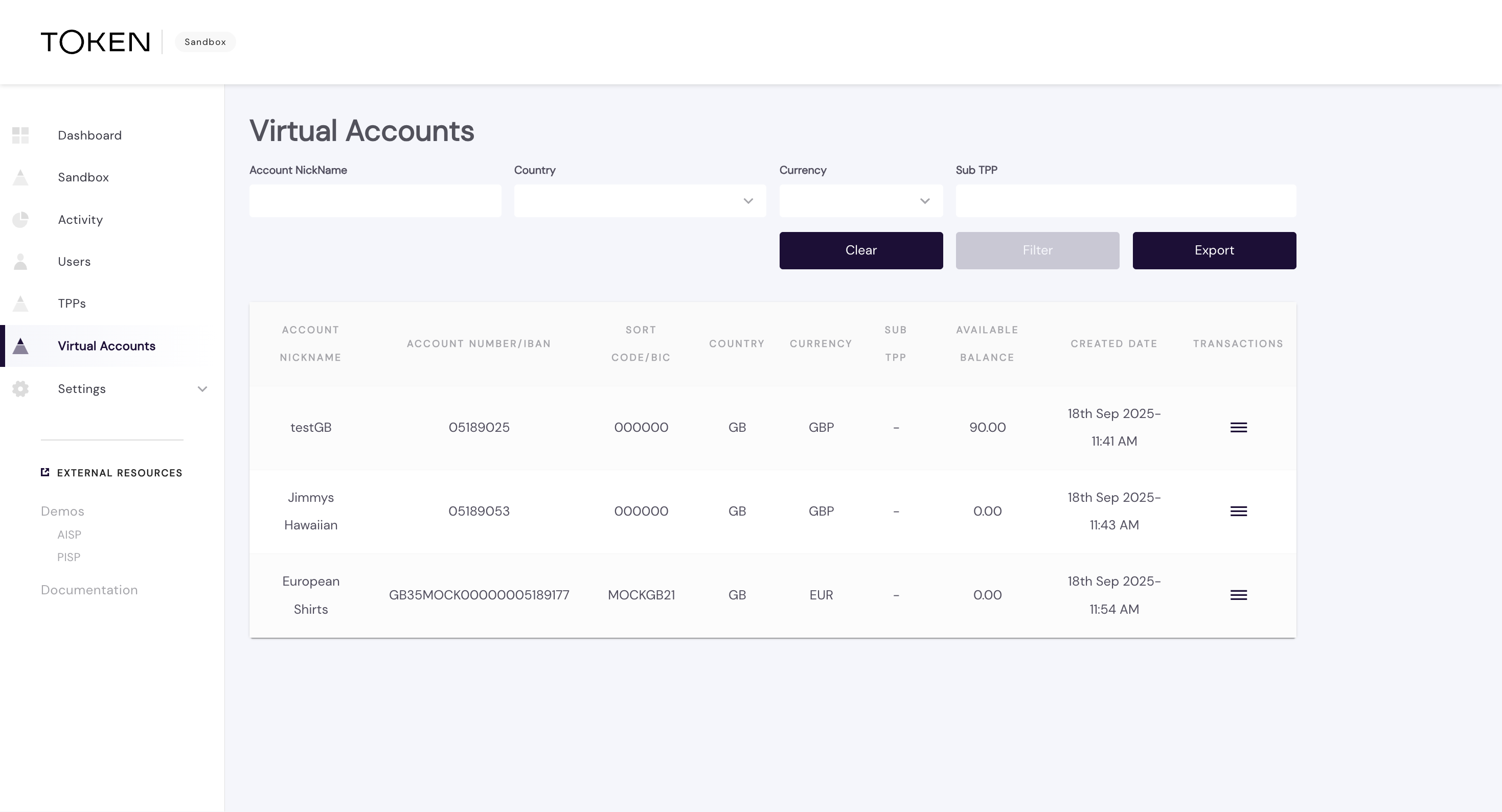

- Access the Virtual Account view in the Dashboard.

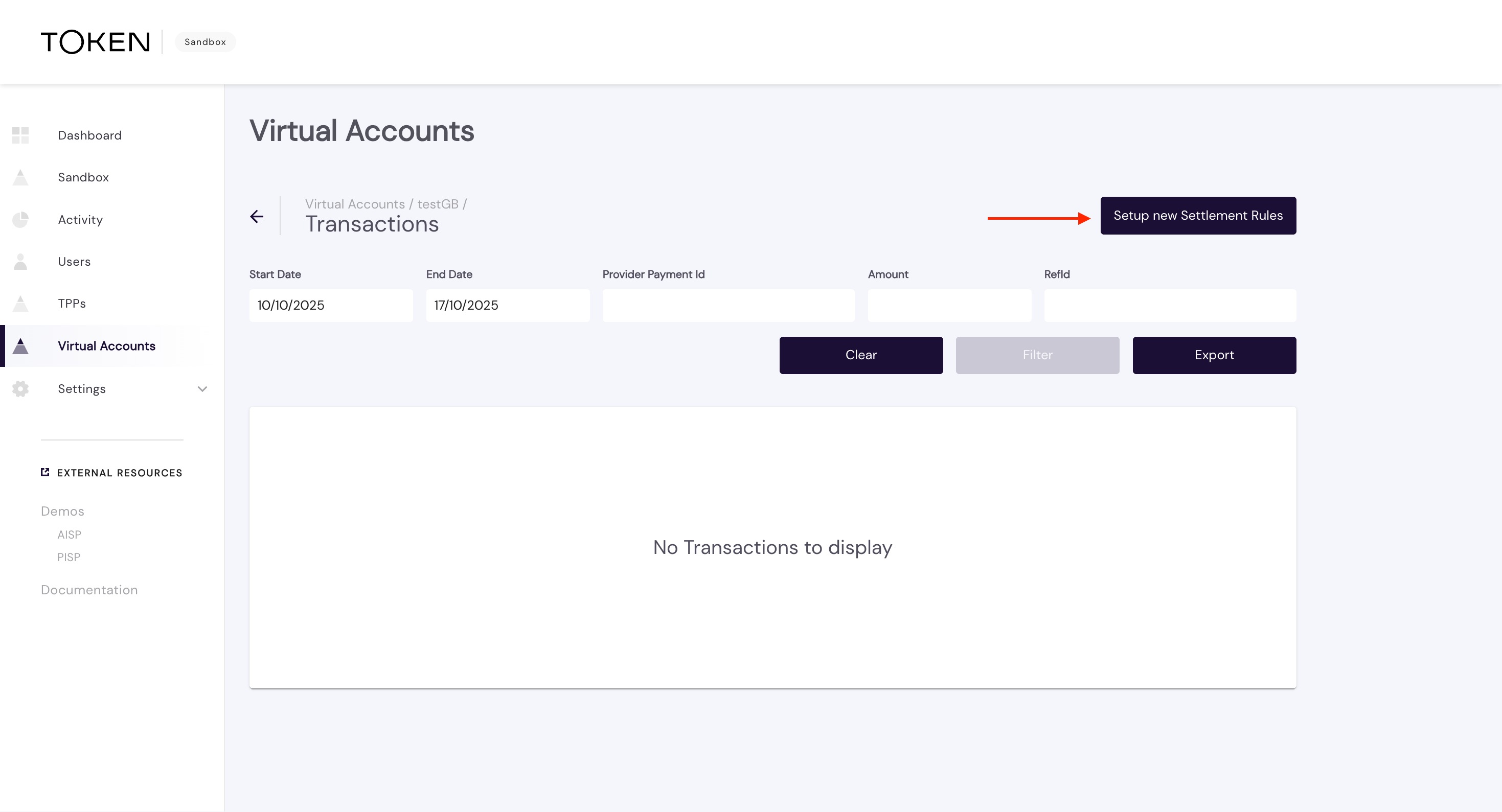

- View the Account Details, then navigate to "View Transactions" in the top right.

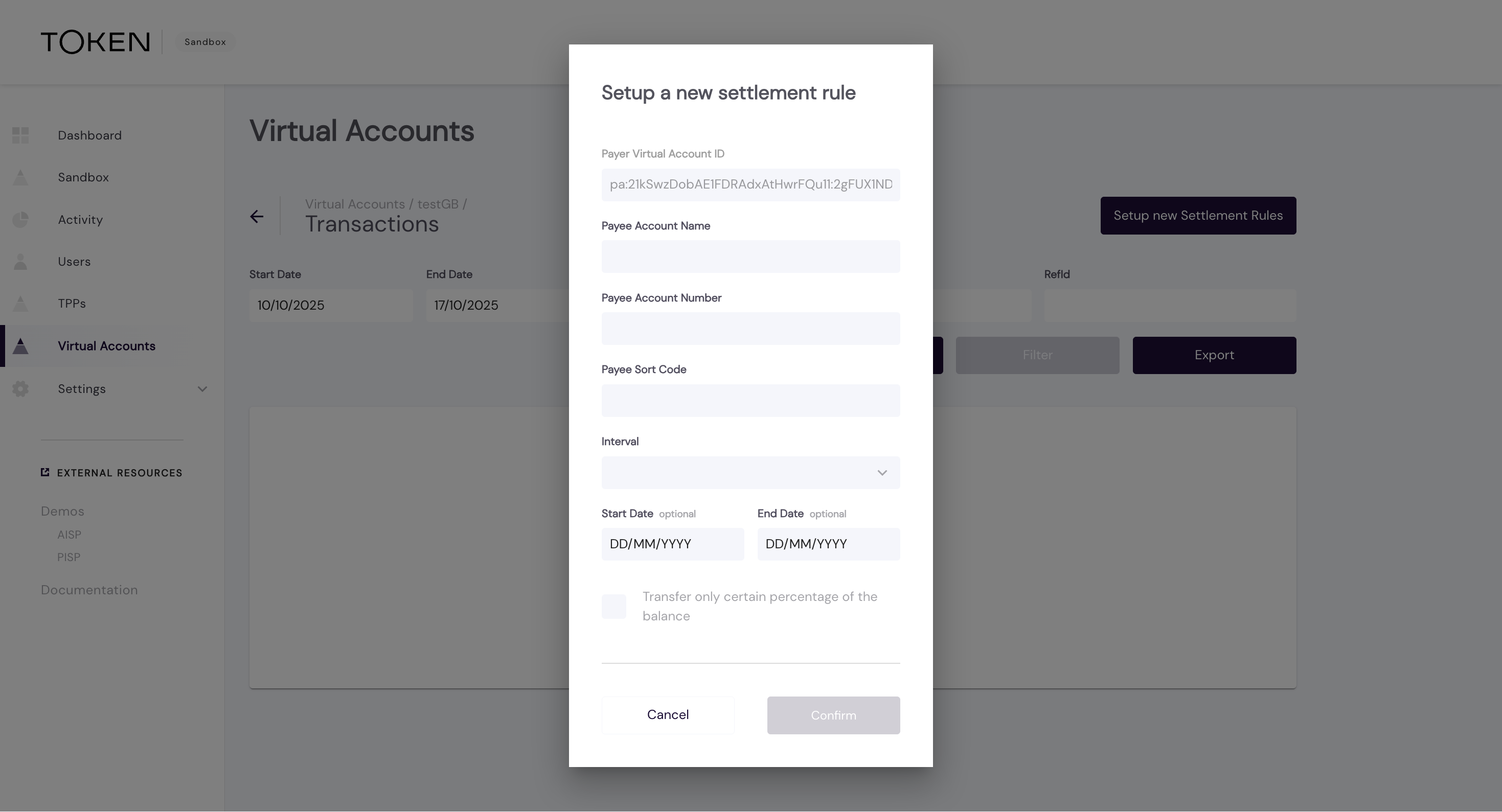

- View the Transaction list for the Virtual Account. Select "Set up new Settlement Rules" in the top right. You will be presented with fields as follows:

- UK accounts: standard fields

- EU accounts: IBAN / BIC fields

- Confirm rule creation once the relevant information is added.

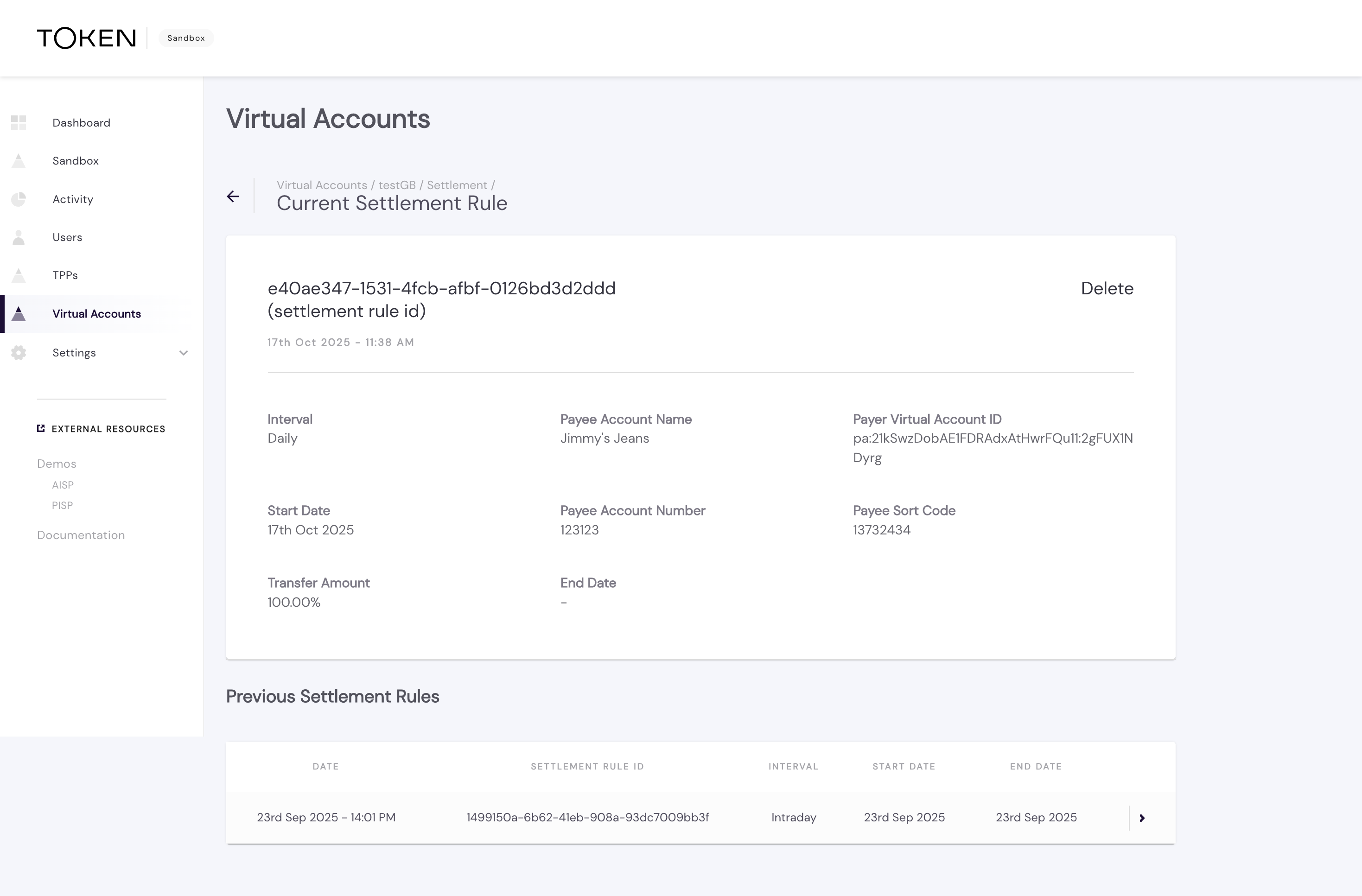

- Confirm the Rule creation - the rule details will appear. If previous rules exist, they will also be visible.

- Delete or update the rule from the top right corner and set up a new one if needed.

Comprehensive documentation is provided for all endpoints, including full API specifications:

🔗 Token Open Banking API - Settlement Accounts

If you have any feedback about the developer documentation, please contact devdocs@token.io