When integrating with the Token.io platform, you'll need to consider:

For more information on specific issues with integrating with Token.io, please see our Knowledge Base in the Token.io Support Centre.

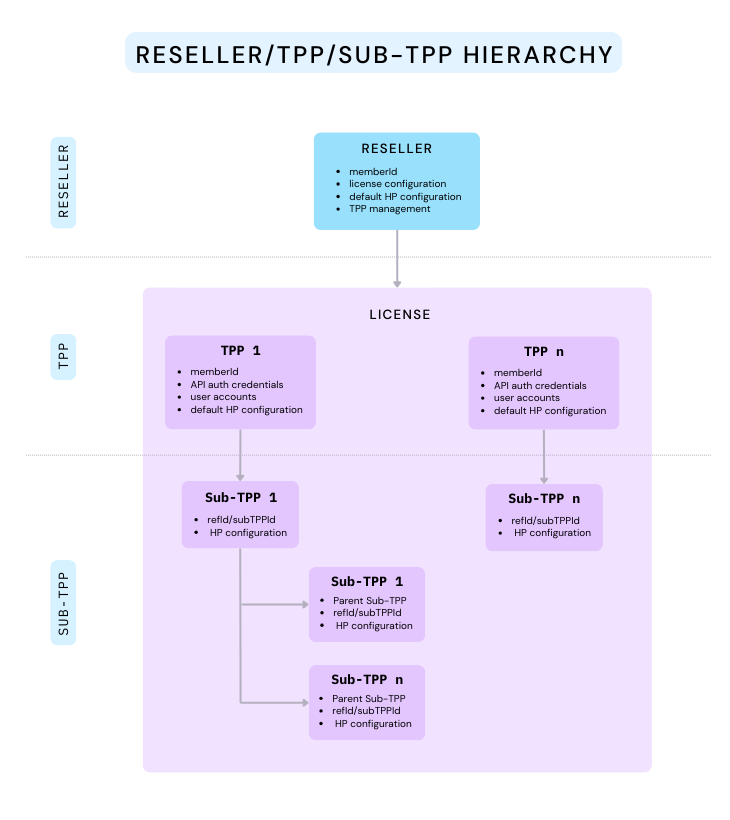

Throughout the Developer Documentation we use the terms reseller, TPP and sub-TPP. The following table describes these entities.

| Technical term | Description |

|---|---|

Reseller | A Token.io Partner - a Payment Service Provider or gateway that uses Token.io as a Technical Service Provider (TSP) to offer Open Banking payments to their customers. A Reseller:

|

TPP | A Token.io Client - an authorized online Third Party Provider (TPP) introduced as part of Open Banking. TPPs exist outside of the account holder’s relationship with their bank but may be involved in transactions carried out by the user. A TPP:

|

Sub-TPP | A Token.io Sub-client - an entity onboarded by one of Token.io's TPPs which does not have a direct relationship with Token.io. A sub-TPP:

|

Within the Token.io ecosystem, TPPs are classified by four types:

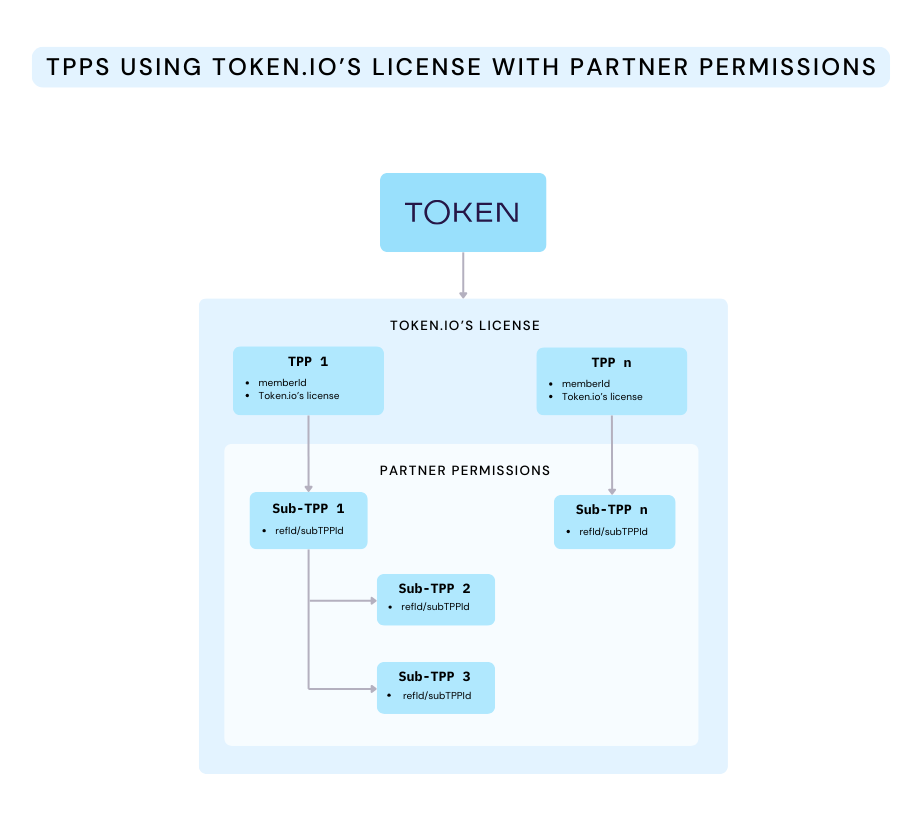

When granted Partner Permissions by Token.io, TPPs using Token.io's license register, onboard and manage their own sub-TPPs (merchants and/or PFMs). By contrast, a TPP operating under its own verified NCA license extracted from its validated QSealC or QWAC can opt to administer its own realm , creating and maintaining its own bank connections. The preferred model for most TPPs with Partner Permissions, however, is to operate under Token.io's realm to onboard and manage sub-TPPs.

These Token.io-Reseller-TPP chains take the respective forms that follow.

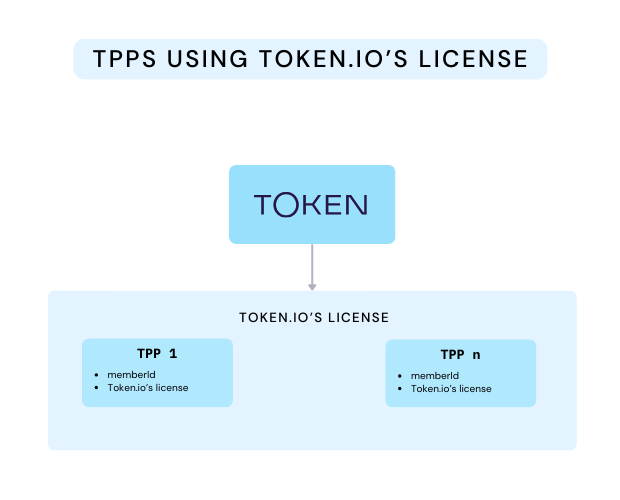

The TPPs in this category operate under the aegis of Token.io's license, inheriting Token.io's bank configurations.

These TPPs:

are identified by a unique

memberIdcan provide Token.io-hosted Open Banking services (PIS, AIS,)

are granted access using their own API authentication credentials

inherit Token.io's bank registrations and configurations

can create and maintain user accounts

Use case - Clients who want to use Token.io's license and integrate our API and Hosted Pages to connect with banks as simply as possible.

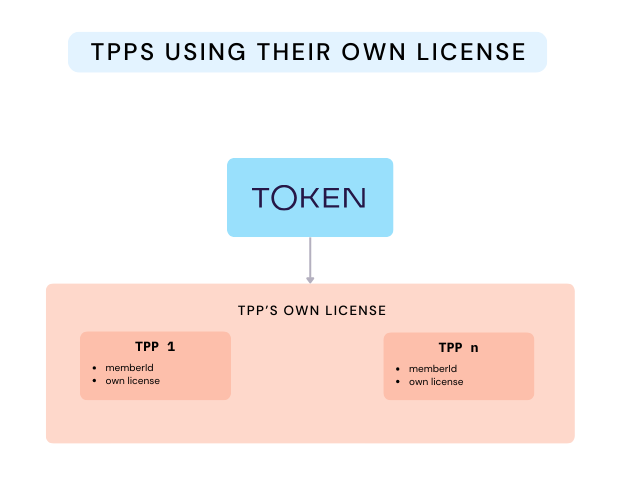

TPPs in this category operate under their own license.

These TPPs:

are identified by a unique

memberIdcan provide Token.io-hosted Open Banking services (PIS, AIS,)

are granted access using their own API authentication credentials

can create and maintain their own bank registrations and configurations

can create and maintain user accounts

If you opt to use your own TPP license, you'll eventually need to register it with Token.io by raising a support ticket. Visit Token.io Support and select Technical Request. Upon completing the registration process, you'll not only have access to the developer sandbox, you'll have already completed certificate registration when you're ready to graduate to production.

Use case - TPPs with their own license who want to use the Token.io API to connect to banks but do not require any further structure in our environment for their clients.

TPPs in this category are similar to TPPs using Token.io's license in the first category, except that these TPPs have been granted Partner permissions. This means that they can create sub-TPPs that also operate under Token.io's license. A unique actingAs.refId assigned when the sub-TPP is onboarded is verified against the sub-TPP's Open Banking permissions for each API call made on its behalf by the TPP Partner.

These TPPs:

are identified by a unique

memberIdcan provide Token.io-hosted Open Banking services (PIS, AIS,)

are granted access using their own API authentication credentials

inherit Token.io's bank registrations and configurations

can create and maintain user accounts

can create sub-TPPs

Use case - TPPs who want to resell Token.io's license and use the same API credentials for each sub-TPP client.

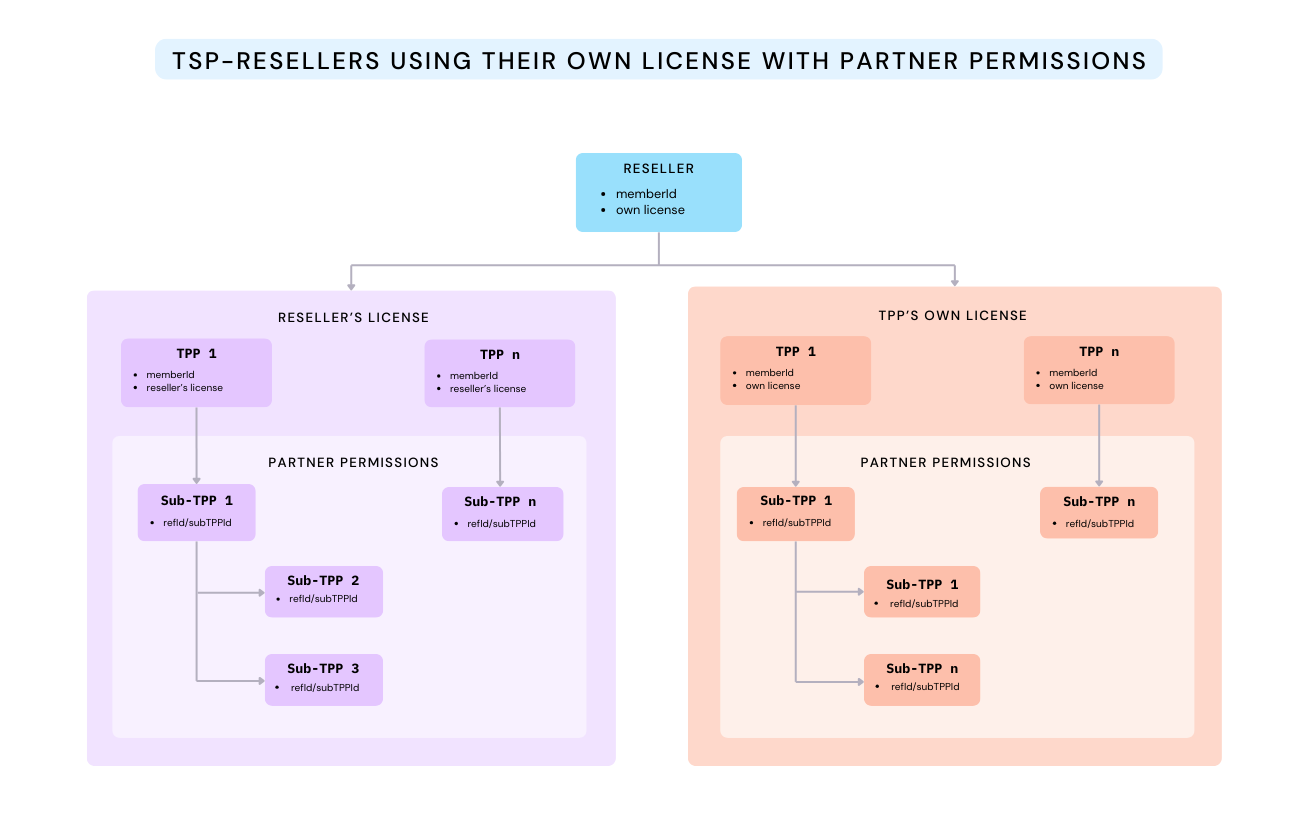

TPPs in this category are true TSP-Resellers operating under their own realm, rather than Token.io's, supporting both sub-TPPs using the reseller's license and TPPs using their own license.

These Resellers:

are identified by a unique

memberIdare granted access using their own API authentication credentials

can create and maintain their own bank registrations and configurations

can create and maintain user accounts

can provide Token.io-hosted Open Banking services (PIS, AIS,)

provide whitelabel interfaces and functionality to onboarded sub-TPPs

can support TPPs operating under the TPP's own license

Use cases

Token.io TPPs wishing to whitelabel and resell the Token.io API under a partner agreement and who therefore require a unique

memberIdfor each merchant they support.TPPs that abstract the Token.io API for use within their own API.

TPPs wishing to streamline the API credentials needed to interact with configured banks.

TPPs that want to support TPPs with their own sub-TPPs, as well as TPPs that use their own license.

New TPPs register and onboard by creating a Token.io Dashboard account. TPPs with Partner permissions register new sub-TPPs via the Dashboard.

To obtain Partner permissions, contact your Token.io representative for assistance with setting up a reseller account. Once the required partnership agreements have been executed, you'll receive unique login credentials that allow access to the Dashboard's TPP Manager and other reseller functionality, from which you can create and manage new TPPs and/or sub-TPPs, as appropriate.

If you have any feedback about the developer documentation, please contact devdocs@token.io